The clinical research industry is experiencing a period of unprecedented growth, fueled by a confluence of factors: rising investment in life sciences, an aging population with increasing healthcare needs, and a focus on innovative treatments. This positive trend translates to excellent news for owners of clinical research sites (CRS) considering a sale. If you have questions while reviewing this information, don't hesitate to reach out to Senior Clinical Research M&A Advisor, Hannah Huke, hannah@evergreenforfounders.com. Hannah has helped CRS owners like yourself navigate this complex landscape and can advise on if a sale is right for your at this time or in the future.

Market Update: A Seller's Paradise

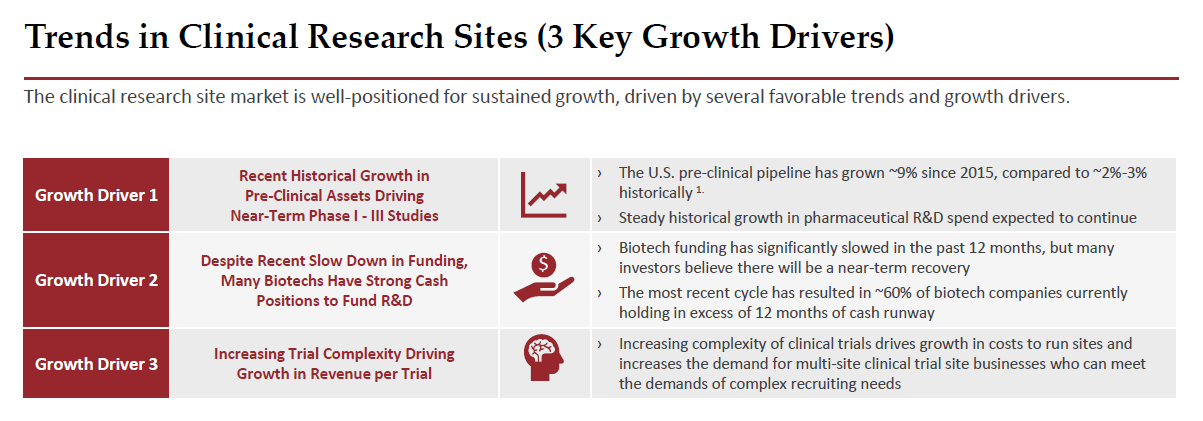

Data from Harris Williams highlights the strong demand for high-quality CRS assets. Clinical Trials are becoming more complex, and those CRS companies that can meet the demand for complex recruiting, enrollment, and retention needs will certainly be at an advantage. The data indicates not only a steady rise in pharmaceutical R&D spending, but also significant increase in cash reserves by biotechs, signaling a near term boom for research initiatives.

Source: Harris Williams

There are over 20,500 clinical trial sites in the US, with 95% being single sites (Source: Harris Williams). Pharmaceutical sponsors and CROs are increasingly looking to contract with fully integrated models. These models offer a wider range of services, broader geographic reach, and deeper therapeutic expertise compared to individual sites or smaller networks.

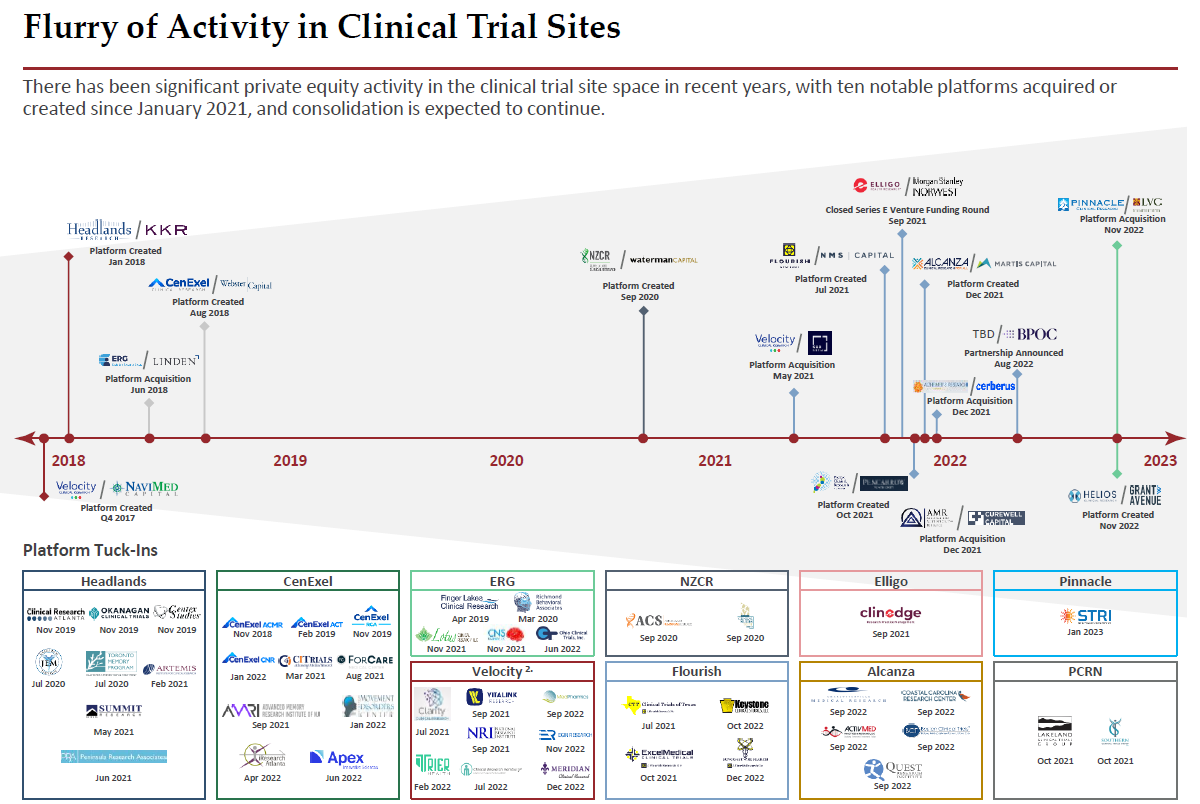

Strategic acquirers are actively seeking to expand their capabilities and geographic reach to meet the demand for a higher complexity of trials. Additionally, private equity firms are recognizing the attractive returns offered by the clinical research space, fueling their investment in platform companies looking to acquire CRS assets. As a result, M&A activity in the sector is rising, with valuations reaching all-time highs. At Evergreen M&A, we recently received a 9x multiple for a business with $2M EBITDA, resulting in an offer that was $5M more than before they had engaged our services.

This surge in demand creates a seller's market for owners of well-established, well-managed CRSs. Here's a closer look at why now might be the perfect time to explore a sale:

- Premium Valuations: Competition among buyers drives valuations upwards. You can expect to receive a strong offer that reflects the value you've built in your CRS. Other things that affect valuations are study pipeline strength, margin sustainability, therapeutic area, principal investigators, and business development capabilities. Having an advisor like Evergreen M&A run a competitive process will also ensure you get the highest offer, combined with the most favorable terms and best cultural and strategic fit.

- Rapid Transaction Time: With high buyer interest, the sale process can proceed efficiently, minimizing disruption to your business operations. Again, having an experienced advisor to manage the entire process from beginning to end will set and reach milestones and deadlines, all while you can keep your focus on running your Clinical Research Site.

- Multiple Exit Options: Strategic buyers and PE-backed platforms compete for your business, giving you the leverage to choose the offer that best aligns with your goals. There have been at least ten notable platforms acquired or created since January of 2021 (Source: Harris Williams). You can expect to roll a portion of your equity from your initial sale into the buyer's platform, realizing a "second bite of the apple," or an even more lucrative return on your investment at the next liquidity event for the platform.

Source: Harris Williams

Beyond the Numbers: Strategic Considerations

While the current market offers significant financial benefits, selling your CRS is a major decision. We're here to help you ensure your goals and values are aligned with the buyer's. Here are some key factors to consider:

- Growth Potential: Does your CRS have a strong track record and a clear path for future growth? Buyers value sites with demonstrable success and a pipeline for attracting new business.

- Your Role: Are you looking to retire in a few years, or do you want to stay on and continue to grow your CRS with the support of the buyer? We've also seen CRS owners take on executive roles with the platforms. What do you want and how can we get you there? These are important considerations as you're reviewing offers.

- Strategic Fit: Carefully evaluate potential buyers to ensure a good strategic fit. Look for a partner who shares your vision for the future of the CRS and will provide the resources to support its continued success. We'll also ensure the platform or buyer has a strong plan to achieve growth for continued returns should you invest your equity as part of the sale.

- Legacy and Impact: For many founders, their CRS represents a significant part of their professional legacy. Choose a buyer who values the company culture and is committed to maintaining the positive impact your site has on the research community.

Partnering with a Mergers & Acquisitions Advisor

Navigating the complexities of selling a CRS in a competitive market requires specialized expertise. A reputable M&A advisory firm with a deep understanding of the clinical research landscape can be your most valuable asset. Evergreen M&A has worked with Clinical Research Sites and is skilled at managing the entire process with your best interests always at the forefront of the transaction.

An experienced advisor will:

- Guide you through the M&A process: From initial valuation to due diligence and negotiation, we'll ensure a smooth and efficient transaction.

- Identify the right buyers: We'll leverage our network and market knowledge to find the most suitable strategic or financial buyers for your CRS.

- Maximize your deal value: With our negotiation expertise, we advocate for the best possible terms and maximize the return on your investment. There are opportunities for negotiation at every turn of the deal process.

- Reduce your risks: An advisor will mitigate common pitfalls, advise you on what to do throughout, and ensure the transaction closes successfully.

Conclusion

The clinical research market is booming, presenting a unique opportunity for CRS owners seeking to capitalize on their hard work. By partnering with a trusted M&A advisor, you can navigate the sale process with confidence and achieve a successful outcome that rewards your dedication to advancing clinical research.

We invite you to schedule an introductory conversation with our Senior M&A Advisor, Hannah Huke, hannah@evergreenforfounders.com or complete the form below and we'll be in touch.

SCHEDULE A CALL WITH HANNAH HUKE